What is E-Filing?

The process of electronically filing income tax returns is known as e-filing. You can either seek professional help or file your returns yourself from the comfort of your home by registering on the income tax department website or other websites

What is Income Tax Return?

Income Tax Return is the form in which an assessee files information about his Income and tax thereon to Income Tax Department. Various forms are ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7. When you file a belated return, you are not allowed to carry forward certain losses. The Income Tax Act, 1961, and the Income Tax Rules, 1962, obligates citizens to file returns with the Income Tax Department at the end of every financial year. These returns should be filed before the specified due date. The due date for filing tax returns (physical or online), is July 31st of each year

Toll free no: 1800 4250 0025 / +91 80 2650 0025

Refund /Refund re-issue Rectification Notification & Processing: 1800 425 2229 / 1800 103 4455

Types of E-Filing?

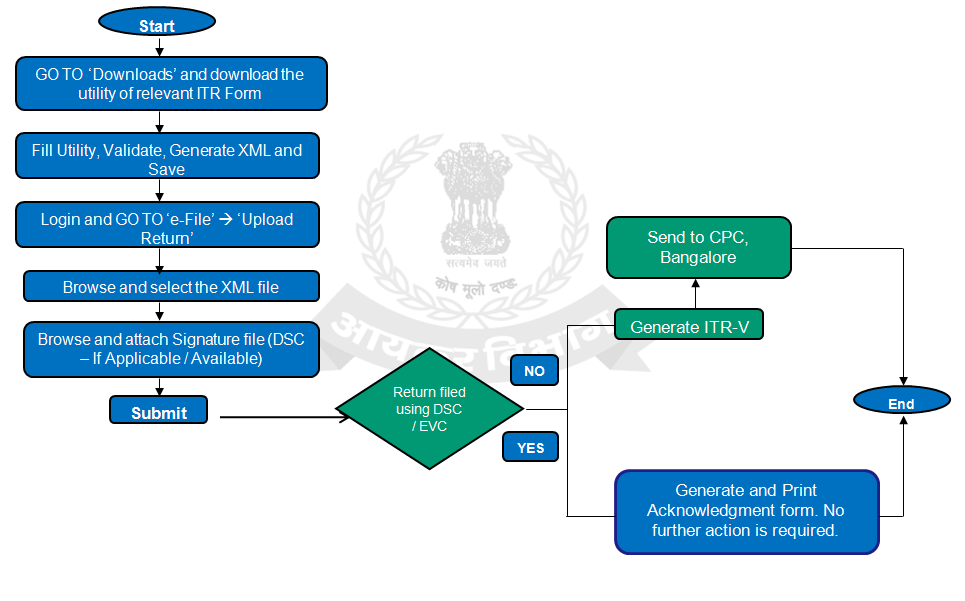

- E-File without Digital Signature Certificate. In this case, an ITR-V Form is generated. The Form should be printed, signed and submitted to CPC, Bangalore using Ordinary Post or Speed Post ONLY within 120 days from the date of e-Filing. There is no further action needed if ITR-V Form is submitted

- E-File the Income Tax Return through an e-Return Intermediary (ERI) with or without Digital Signature Certificate (DSC)

- Use Digital Signature Certificate (DSC) / EVC to e-File. There is no further action needed if filed with a DSC / EVC

What is required to pay income tax online?

- PAN (Permanent Account Number)

- TAN (Tax Deduction Account Number)

- Bank account details

- Rent receipts for claiming HRA

- Form 16

- Payslips

- Interest statements

- TDS certificates

- Details of investments

- Insurance and home loans handy

- Downloaded Form 26AS

Online procedure to pay online income tax or e-Payment:

- The taxpayer needs to visit E-Filing official website. Click next link to visit E-Filing official website Click Hear File Tax Return Online

- Post visiting this link a window will appear which will look like the same first image posted below. Then go for

- Registration process if you are not registered or if you are registered then log in with your credentials

- Provide PAN / TAN, Password details, Personal details as per PAN / TAN, Contact details and Digital signature (if available and applicable)

- Submit request

- On success, Activation link is sent to the user through e-mail and a mobile PIN to a mobile number. Click on the activation link and provide Mobile PIN to activate e-Filing account

- Once registered, Login using User ID, Password, Date of Birth/ Incorporation and Captcha code

- Preparing the Income Tax return offline using return preparation software available free of cost at the Income Tax Department e-Filing website and Uploading the Income Tax Return data- A taxpayer can e-File Income Tax Return from ITR 1 to ITR7

- Submit ITR-1/ITR4S Online An Individual taxpayer can prepare and submit Income Tax Return- ITR 1/ITR4S Online

- Steps to prepare and upload Income Tax Return Offline

- Step 1: e-Filing Home Page

- Step 2: Click on the “ITR” under “Downloads”

- Step 3: Click on “Download” link and save the ZIP file (Excel or JAVA utility)

- Step 4: Extract the downloaded ZIP File

- Step 5: Open the utility, Click on “Import Personal / Tax details from XML” Browse and attached the downloaded Prefill XML file to populate the personal information and TDS details

- Step 6: Enter all the Mandatory Fields Validate all the sheets Calculate Tax Generate XML

- Step 7: Login using e-Filing user credentials

- Step 8: Navigate to “e-File” Tab Click on “Upload Return”

- Step 9: Select “ITR Form Name” and “Assessment Year” from the drop-down provided

- Step 10: Browse and attach XML file

- Step 11: Select “Do you want to digitally sign?” Submit

- Step 12: On successfully submit taxpayer will get an option to e-verify return

- Steps to submit ITR-1/ITR4S Online

- Step 1: Login to e-Filing application

- Step 2: GO TO ‘e-File’ –> ‘Prepare and Submit ITR Online’

- Step 3: Select the Income Tax Return Form ITR 1/ITR4S and the Assessment Year

- Step 4: Fill in the details and click the SUBMIT button

- Step 5: On successful submission, Acknowledgement detail is displayed. Click on the link to view or generate a printout of Acknowledgement/ITR-V Form

- On generation of “Acknowledgement“, the Return Filing process is complete

Contact Details:

- E-Filing of returns (Helpdesk): 1800 4250 0025

- Refund /Refund re-issue Rectification Notification & Processing: 1800 425 2229 /+91 80 2254 6500 / 1800 103 4455

References & details:

- For more details regarding documents and other help please visit official website

- E-Filing official website: https://incometaxindiaefiling.gov.in/

- Income Tax Department: http://www.incometaxindia.gov.in/Pages/e-payment.aspx

- FAQ’s: https://incometaxindiaefiling.gov.in/#EFQ1

- Procedure of E-Filing: https://govinfo.me/wp-content/uploads/2016/12/How_to_File_Presentation.ppt or https://govinfo.me/wp-content/uploads/2016/12/How_to_File.pdf