Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by income tax department. It is required to conduct simplest of financial transactions. It is useful for taxation purposes. PAN Card is a valid identity proof of citizens of India.

Need of PAN Card:

PAN Card is a mandatory for filing IT Returns, it is required for opening bank accounts, income tax purposes, as a proof of identity, opening Demat account, sale or purchase of assets, etc.

Important documents required while applying for a PAN Card:

Proof of Identity: Any 1 of the following documents

- Aadhaar Card

- Voter ID Card

- Driving License

- Identity Card issued by Govt. organisation

- Applicant Photo

Proof of Address: Any 1 of the following documents

- Passport

- Water bill

- Electricity Bill

- Ration Card

- Telephone bill

- Driving License

- Voter ID Card

- Property Tax Receipt

Passport sized photo

Age/DOB Proof: Any 1 of the following documents

- Birth Certificate

- Driving license

- Domicile certificate

- Passport

- Marriage certificate

How to Apply for PAN Card:

One can apply for PAN Card in Madhya Pradesh by both Online and Offline process –

For applying Online:

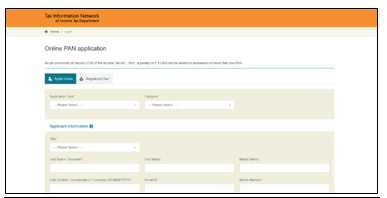

Visit the official website of NSDL @ https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

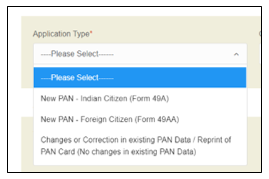

- Click on ‘Application Type’ and select on ‘Form 49A for resident individuals’ from the drop-down list.

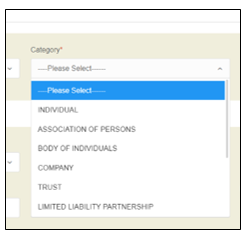

- Select category ‘Individual’ from the drop-down list

- Fill in the details like Full name, DOB, Title, mobile no., email ID, etc

- Then click on Submit tab.

- A token no. will be generated and sent to the registered mobile no. and email ID.

- Click on the link to continue with the application or go the homepage and click on Registered user tab. Login and complete the application process

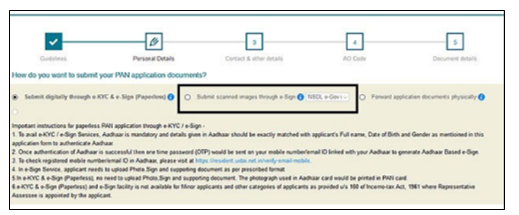

- On the next page displayed, select any one of the 3 options available regarding submission of application – 1) submit digitally via e-KYC and e-Sign 2) Submit scanned images through e-Sign 3) Forward the documents physically.

- Then, on the next page enter the details like Aadhaar details, parents’ names, etc. Applicant has an option to print either mother’s name/ father’s name on the PAN Card.

- Then fill in the personal details like, residential and communication address, mobile no., email id, source of income, etc

- Then click on Next. On the next page applicant needs to fill in the area code, range code, AO number etc. All the instructions and details will be available on the website itself.

- Upload the documents for proof of address, identity, DOB, photo and signature. Fill in the declaration with name, place and date and Submit.

- Then the applicant will be redirected to the payment page. A minimum of Rs.110- 115.90 with bank charges will have to be paid through online mode or demand draft.

- Then Aadhar authentication will be conducted via OTP on the registered mobile/email.

- After proper verification, a receipt will be generated. Take a printout of the receipt which has a 15-digit acknowledgement no. This 15-digit acknowledgement no. is a proof of transaction for future use while obtaining the card

- On successful document verification by the concerned authorities, the card will be dispatched to the registered address. e-PAN will also be provided on the registered mail Id.

For applying Offline:

- The applicant is required to locate the nearest authorized PAN Card Centre/ Office/ District level PAN agency. Even the applicant can contact any agent of UTIISL for the offline application

- Visit the centre with required documents like, identity proof, address proof, DOB proof and photos.

- Get the application form from the centre. Fill in the details, name, address, mobile no., gender, email id, DOB, etc.

- Review and complete the process. Submit the form and required documents at the centre.

- Application form can also be downloaded from the official website. Take a printout and duly fill the application form and submit the same with required documents at the centre.

- A minimal fee payment will have to be made at the centre.

- On successful document verification by the concerned authorities, the card will be dispatched to the registered address. e-PAN will also be provided on the registered mail Id.

Processing Time: 15-20 days

Enrollment: An eligible citizen should apply for PAN card only once. As per section 272b of Income Tax Act, 1961, a penalty of Rs. 10,000 can be levied on possession of more than 1 PAN.

Age limit: Minimum age limit to apply for a PAN card is 18 years.

Validity: PAN is valid forever. It is a Permanent number.