The sovereign gold bond scheme was launched in the year 2015. Under this scheme RBI issues sovereign gold bonds for investors. Sovereign gold bonds (SGBs) are securities/bonds issued by the RBI on the behalf of the government, which are denominated in the form of gold grams. Minimum investment allowed under this scheme is 1 gram and maximum investment allowed is 4kgs for individual and 20kgs for trusts and other entities. Bond issues are open for subscription by the public in Tranches. RBI decides the rates of SGB for each new tranche and a press release is published for the same.

For the 6th tranche of the SGB scheme, RBI has decided the issue price as Rs. 5,117 per gram. It will be open for subscription from August 31,2020 to September 4, 2020.

Overview:

| Scheme name: | Sovereign Gold Bond (SGB) Scheme |

| Launched Under: | Central Government |

| Issues By: | Reserve Bank of India (RBI) |

| Scheme Type: | Gold Bond Scheme |

| Scheme Benefit: | Investment in Sovereign gold bonds |

| Objective: | To reduce the demand for physical gold and to encourage financial savings instead of dead investments. |

Objectives and Benefits:

- The main objective of the scheme is to encourage financial savings and investment in bonds and securities instead of purchasing gold

- SBG scheme aims to reduce the demand for gold purchase and shift the same amount to savings and investment in SBGs

- Purchase and sale of SBGs will lead to flow of finance in the economy as a whole

- This scheme enables the investors to earn interest every 6 months as well as on maturity

- Under the scheme, bonds are issued directly by RBI, thus it is a safe investment

- It is easy to buy and sale the SGBs under the scheme, the bonds are available in both paper as well as demat form.

- This scheme aims at reduce the import of gold in the long run.

Eligibility:

- Foreign Exchange Management Act of 1999 (FEMA) has designed the eligibility criteria as to who are eligible and who are not eligible for investment under the scheme.

- All the Individual Indian Residents, Associations, Trusts, HUFs, Universities and Charitable Trusts are eligible for investment

- Minors cannot hold the bonds directly, however their parents can hold the same on their behalf

Sovereign Gold Bonds (SGB) Scheme 2020-21 details:

- The sovereign gold bond scheme will be open for subscription for a period of 5 days.

- The dates of tranche are from August 31 to September 4, 2020

- This is last tranche for this financial year, post this gold bonds will then be available next year.

- This is 6th tranche of SGB scheme 2020-21, the 1st was in April 2020

- Issue price declared by RBI is Rs. 5,117. This price is decided based on an average of spot rates as provided by India Bullion, Mumbai and Jewelers Association (IBJA).

- Investment in these gold bonds is for a period of 8 years (maturity) and exit option is available after the first 5 years

- 5% of returns are available annually on the gold bonds.

- Interest is taxable while capital gains are exempted on these gold bonds.

- Gold bonds can be brought with a minimum of 1 gram to maximum 4 kgs for individuals and HUFs and 20kgs for trusts and other entities.

- These can be brought from stock exchanges BSE/NSE, Bank branches, SHC and Post offices.

- Government has decided to provide a discount of Rs. 50/- on every gram of gold for investors applying and paying online. The issue price for such investors doing online transactions will be Rs. 5,067 per gram

- This is decided in consultation with RBI and the main aim is to promote digital/ online transactions and investments.

- The SGBs can be further traded and redeemed as preferred by the investor.

Mandatory Requirement:

- Applicant should an Indian Citizen

- KYC completion is mandatory. Documents required for KYC are Aadhaar card/PAN/TAN/Passport/Voter Id

How to Apply:

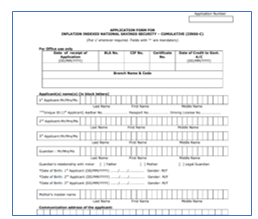

For buying SGBs, both online and offline processes are available. Applicant needs to fill a form and complete KYC process.

Offline Mode:

- Applicant can himself visit the bank branch/post office/ exchange/agents.

- Take the form and fill it manually and submit. Application form is also available on the official site of RBI @ rbi.org.in

- After verification and processing the gold bond units will be issued as per application.

Online Mode:

- Applicants can apply online through listed banks/ SHCIL and Demat accounts

- For starting the investment, applicant needs to have a valid net banking account.

- Log in to the net banking account, click on SGB option on the home page

- Ongoing tranche details are usually available on the home page itself

- Ensure the completion of KYC process.

- Then go ahead with registration process, fill in the details like name, address, PAN no., Aadhaar no., Nomination details, etc

- Enter the no. of units to buy, as per the price already declared by RBI

- 1 unit is equal to 1-gram gold.

- Applicant can apply online through Demat account, wherein you buy the units and those get credited in the demat account. Once these bonds are listed, trading can be done.

- Applicants can also buy the units online through brokers/agents